“Every day the bucket goes to the well

One day the bottom will drop out” I Shot The Sheriff, Bob Marley X Eric Clapton

“We must remember that delusions swing between extremes, like pendulums. Delusions of grandeur and unending wealth give place to delusions of unending gloom. One is as unreal as the other.” Bernard Baruch

“People always want to believe that this time is different, that there’s something new under the sun, and that through their own ingenuity they can wish away risk.” Seth Klarman

“The remarkable thing about Monday’s late rally and this morning’s so-far follow thru is that it occurred from a Bulls Eye Time/Price Square-out:

April 21st squares out with 511 on the Square of 9 Wheel (which translates to 5110).

Monday’s low 5`101.Monday’s close, 5158”

The above is from Tuesday morning’s Hit and Run Report

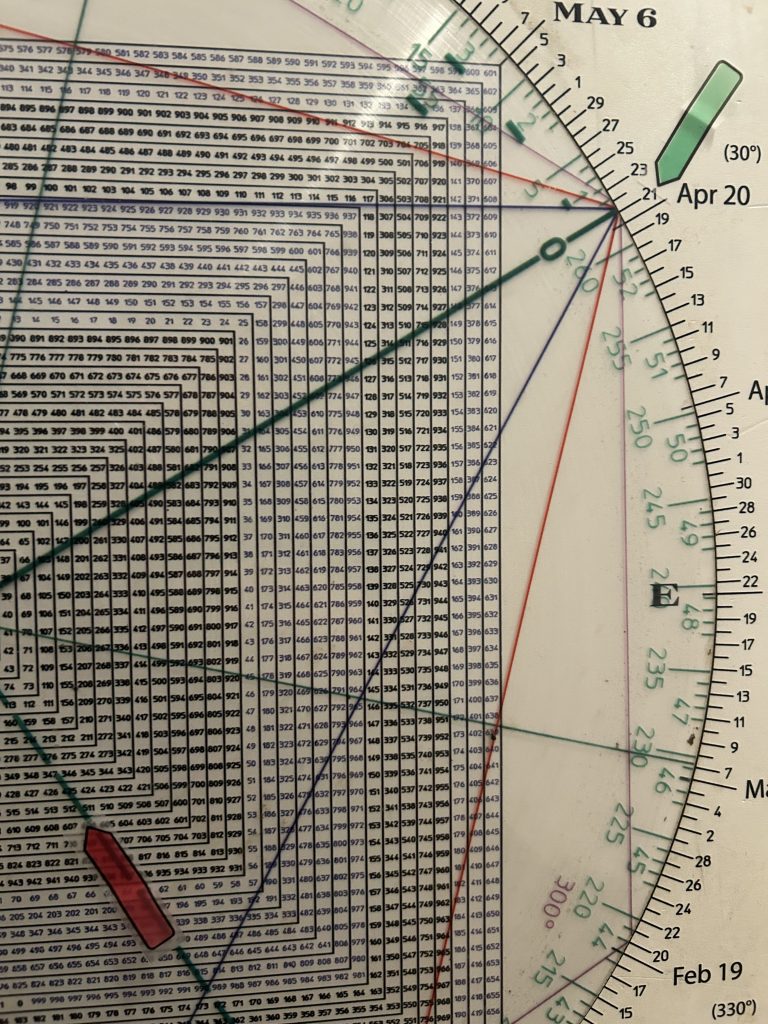

Below is an image from the Square of 9 Wheel depicting the square-out.

April 21, green

511, red

You can’t make this stuff up.

So far this year our Roadmap which we breakdown every day for the short term pivots has proved to be prescient.

What’s next?

Tuesday we also showed the following SPX daily showing the Monday’s square-out tested a Bottoms Line (green) connecting the Oct 2022 low and the Oct 2023 low.

The Bottoms Line interested with horizontal support (blue).

This horizontal report ties to the May 2024 pullback breakout, and the August air pocket low.

Consequently the early April low forms 3 points on a rising trend line as well as on a horizontal basis.

The early April lows undercut the line but exploded 10% to its 20 day moving after the test.

Tuesday’s low tested this critical juncture underscoring the significance with the aforementioned Time/Price square-out: April 21 and 511.

Breakage below this Maginot Line will be in conjunction with a crash.

The initial rip off the early April low is no surprise as it came after satisfying our projection for a test of the January 2022 peak.

It also came on a White House Tape Bomb, a tariff “pause”.

The news breaks with the cycles, not the other way around.

Apparently there’s a lot of cycles and sheriffs at the White House.

Yesterday’s rally front ran another tape bomb from the Trump/Bessent tag team:

1) After lambasting Powell saying his termination couldn’t come soon enough, yesterday Trump says he has no intention of firing Powell.

2) Bessent chimed in with “there will be de-escalation in the trade war with china in the “very near future.”

3) Trump declared, tariffs on goods from China will “come down substantially, but it won’t be zero” adding “I’m going to be very nice to China and not play hardball with President Xi.”

It’s a game of trillion dollar red light, green light.

The trouble is with enough “red and green” pretty soon you’ve got mud.

It is stunning how the short term cycles and technicals as shown in my Weekly Buy/Sell Indicator have been able to catch the Whiplash.

Our expectations for a rip in the market and a top in gold were flagged in Tuesday’s Hit and Run Private Twitter Feed.

For example, Hit and Run bought SPXL an hour before the close on Monday.

Members added to SPXL on Tuesday’s late-day pullback.

Here are the geometric levels to watch measuring off the SPX 4835 April 7 low.

540 degrees up from low = 5260

720 degrees up = 5404 which ties roughly to the overhead 20 day moving average.

The 20 DMA has acted as resistance during the entire decline.

Following two Pinocchio’s of the 20 DMA, the SPX accelerated to the downside

900 degrees up from low =5555

This ties to 50% of the range for 2025 at 5491.

That said a Measured Move of the first leg up off the consistent with the C Wave of an A B C corrective rally gives

5747.

Remarkably 5747 is the 200 day moving average.

How quickly could the SPX get there in this highly charged volatility regime?

575 (5747) squares out with May 9th.

If the SPX runs up into that region in that time-frame there is a strong likelihood it will mark a major top.

Alternatively, if the SPX strikes a C Wave high here in April then the May 9th time-frame could mark a plunge…

With Time squaring out with a presumed high.

Tomorrow’s report will walk thru this critical time period based on historic cycles/events and current cycles.