“And it feels right this time

On his crash course

With the big time.” No Leaf Clover, Metallica

On Friday on the Hit and Run Private Twitter Feed we went out on a limb stating the last hour Friday/first hour Monday (today) may be the most consequential of the first quarter.

That’s before the following Deep Seek news hit over the weekend.

Venom-Fang into the heart of the AI bull

Interesting timing on China’s part right in the face of Trump’s announcement of a $500 billion AI initiative.

What’s a few billion between friends?

It’s one way for China to say take your tariffs and pound sand.

The news breaks with the cycles, not the other way around.

Last week in this space we walked through an array of historic cycles due to exert their downside influence, further compelling evidence underscoring a litany of technical divergences and shorter term cycles pointing to this this late January/early February time framed as extremely significant.

While the price low in the Great Depression occurred on July 8, 1932, the heart of the Great Depression occurred in 1933.

In FEBRUARY 1933, the July 1932 low was tested giving way to a momentous advance into 1937.

On March 5, 1933, newly sworn-in President Franklin Roosevelt declared a bank holiday closing all United States banks and freezing all financial transactions.

The rise of Roosevelt coincided with the rise of Hitler to power.

It was a momentous year.

Underpinning the idea that the largest rallies occur in the midst of Bear Markets, on March 15, 1933 the DJIA rallied from 53.84 to 62.10. The sessions gain of 15.34% achieved during the depths of the Great Depression, remains to this day, the largest 1 day percentage gain for the DJIA.

1933 was 92 years ago.

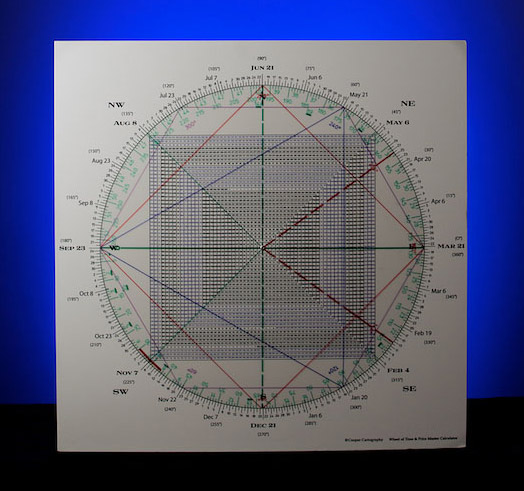

On the Square of 9 Time/Price Calculator, 92 is straight across and opposite January 25th, Friday.

As well 92 squares-out with October 29th, the Big One in 1929.

And, by extension squares January 25th.

Since that was Saturday, today, Monday, squares-out with Panic.

These Time and Price synchronicities are haunting the tape.

Is it possible here in 2025, the market is equal and opposite that Super Cycle low in the early 1930’s? A Super Cycle Top?

A daily SPX shows the breakout above a declining trend line from the Dec 6 high and the subsequent drive to a nominal new high we have had on our radar

The Bulls are saying “don’t cross the red line”.

The red line currently ties to the 50 day moving average this week.

Below that suggests a false breakout, confirming late last week as a Secondary High.

An infamous analogue to the current picture is the Jan/Feb 2020 pre-Covid Crash pattern high.

As was the case then, and is a market truism, False Moves Lead To Fast Moves.

That said, Mr. Market will telegraph his agenda well before breakage below the 50 DMA.

A failure below the Dec 6 high of 6100 that sticks may telegraph his pernicious intent.

That’s not saying much as the SPX closed at 6101 on Friday.

The T Rex in the ointment however is that the SPX gapped up to a new 60 day high and closed near session lows on Friday leaving a Gilligan sell signal.

In addition, judging by the futes Sunday night as I write, there is a better than average likelihood that with tonight’s selling we see a gap down below Thursday’s 6074 low thereby leaving an Island Top.

Interestingly the Secondary High in Feb 2020 was an 8 day Island Top.

On Friday on the Hit and Run Twitter Feed we noted that January 25 squares out with 605 (6050) and that it would not be surprising to see a drop to that region by Friday’s close or by Monday.

Notice that the next 90 degree/square decrement down is 581 (SPY).

Downside momentum opens the door to 581.

The chart below shows the synergy between the 2020 crash and the current pattern.

Notice the parabolic blowoff of roughly 14 months into February 2020 mirrored by a 14 month blow off into the current timeframe.

The black tops line parallels the red bottoms line from the March 2020 low.

Extending that trend line shows that it nailed the October 2022 low and the October 2023 low proving it’s a “good line”.

I drew a parallel trend line from the July 2024 peak and extended it forwards and backwards like a Ghost Line.

Notice how it nails the September high in 2022, the high before the low.

The stock market of the 1920’s became a retail market in a way it had never been before.

When people heard that their neighbor had doubled their money and then doubled it again they started to feel like a fool if they didn’t do it themselves.

But to catch up with their neighbor the had to do something different. Margin.

They all had one thing in common: they think the sky’s the limit.

Maybe they had two things in common: a fool and their money are soon parted.

The Bear has been playing an historic game of hide and seek with excess and valuations for some time…so long that the old Wall Street bromide, “this time it’s different” has gained a new respectability.

But DeepSeek may be the pin that pops the bulls bubble.

The word “bubble” is thrown around a lot, but the chart below reveals that 2-24 (see red arrow at the top of the chart) is the most overvalued market in U.S. history (at least from 1927)

Valuations and divergences don’t matter until Time is up.

Let’s look at the cycles from the last SPX peak on January 4, 2022.

The ‘impulse’ down from the Jan 4, 2022 top to the October 13, 2022 low is 9 + months.

9 + months later was the late July 2023 peak.

Another 9 + months 9 months later gives the April 2024 low.

8 months from the July 2023 peak defined the late March 2024 top.

9 months from the March 2024 top is the December 2024 top (8 months from the April low is the December 2024 top).

9 months from the April 2024 low is January 2025.

This 8 to 9 month cycle has been operating since November 2021, when the NAZ topped…with a 6 week interval acting as a “chain link”.

The overarching theme is the 3 cyclical drives to a high in December 2024/January 2026.

The chart below is the same but showing the Rising Wedge as the last section of the advance produced as the SPX came out of a Cup and Handle following the October 2023 low.

This large Cup and Handle perpetuated a 14 month blow off.

In sum, the last cyclical bull market peak was January 4th, 2020.

We are 37 months from that high.

Maybe something, maybe nothing but on the Square of 9, the number 37 squares out with late January/early February.

37 years ago from what I’m calling a Primary High on December 6, 2024 is 1987, a crash year.

25 years ago was the Tech Bubble Top in early 2000.

On the square of 9, the number 25 squares out with February 4th.

I can’t help but wonder…is NVDA, CSCO?

I can’t help but wonder…the Covid Crash was courtesy of China.

Ditto DeepSeek?

Footnote. The Gann Panic Window 55/56 days from a high, in this case December 6, ended on January 25th. The weekend.

However the market is not a Rolex.

It is worth noting that the Gann Panic Window ended on October 24th, 1929.

That was the day the air came out of the Roaring Twenties Bubble.

But the panic extended through October 29th.

This week is going to be a doozy.

We have the Fed on Wednesday.

We have earnings from META, TSLA and MSFT on Wednesday.

The bull raged back after the August 5, 2024 Flash Crash.

The end of January/early February is 180 degrees straight across and opposite the Flash Crash.

As I like to say, the first mouse gets the squeeze, the second mouse gets the cheese.

The Measured Move to 6118 was a direct hit.

The Gann Panic Cycle while stretched to the limit is making up for lost time today.

The December Indicator is bringing it all back home.

The Bull Trap into our late January cycle top has been sprung.

Square of 9 Wheel

Purchase your own Square of 9 Wheel. Shipping to US only. Contact Jeff for shipping outside the US.