“I’m coming down fast, but don’t let me break you.” Helter Skelter, The Beatles

“There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to accept what is true.” Soren Kierkegaard

Our math road map for Tuesday was powerful bounce (into 529/530 time/price square-out—that level squares August 6th) along with massive volatility.

SPX rallied 5312 to close open gap and dropped 72 points to close at 5240.

It held 5227 which is a key level. It is 540 degrees down from high which is a cube down from the high—a true square.

To recap, I have probably read everything W. D. Gann has written and nowhere do I recall ever seeing him mention “cubes”.

He talks about squares and square-outs repeatedly. Never cubes.

But a cube is a true square. We live in a 3-dimensional world.

Gann stated: “Everything in existence is based on exact proportion and perfect relationship. There is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things”. He quoted Faraday: “There is nothing in the universe but mathematical POINTS OF FORCE.” He is alluding to his Law of Vibration.

Curious that Gann who wrote: “Astrology is important, but math is more important” just “forgot” to mention cubes.

He didn’t forget. It was not his intention to give away all his secrets.

This is why his writings often appear cryptic.

I discovered the significance of cubes in my research for my DVD Unlocking the Profits of the New Swing Chart Method.

In analyzing all the major swings from 1941 I saw that many major swings in price, up and down, were 540 degrees. As well many major swings in time were 540 days/degrees (18 months).

This is a fractal of the Saros Cycle, the Eclipse Cycle of 18 years, when the Earth, Moon and Sun return to the same place in the sky.

Since the ancients told time by the Moon and today we tell time by the Sun, this is a key cycle.

3 cycles of 18 months is 54 months. 54 ties to Gann’s Panic Window.

54 months from the March 2020 Covid Crash is September 2024.

On Wednesday, we saw more massive volatility and instability.

The SPX rallied 90 points off Tuesday’s close to 5330 before plunging 135 points to 5195.

A swing of 225 points.

Wednesday morning’s report identified the upside pivot from where we thought a reversal would occur.

The Roller Coaster is an ODTE Scream Machine.

Hit and Run hit it again on Wednesday buying ODTE SPY puts at 20 cents that exploded to over $1.00.

This is on top of the 10 bagger Hit and Run members scored on Monday morning on August 23rd 525 SPY puts.

But the motherlode was the 30 bagger on Monday’s open:

September also ties to the Gann Panic Window from the July 16th, 2024 Top.

So there is a confluence of cycles due to exert their downside influence in September.

The all-time high is 567 (5670).

567 squares-out with September 11th.

We are 23 years from 9/11.

23 squares out with mid-September.

We have flagged war cycles from 1990 since last summer in this space.

The first atomic bomb was dropped 79 years ago on August 6 , 1945.

79 squares out with August.

It is ironic that the Yen Carry Trade seems on the verge of blowing up the financial system.

Is it possible the unwinding of the Yen Carry Trade detonates the Derivative Bomb?

Since the Spring we have been concerned about a mirror image foldback from 1929.

The 1929 crash was 95 years ago.

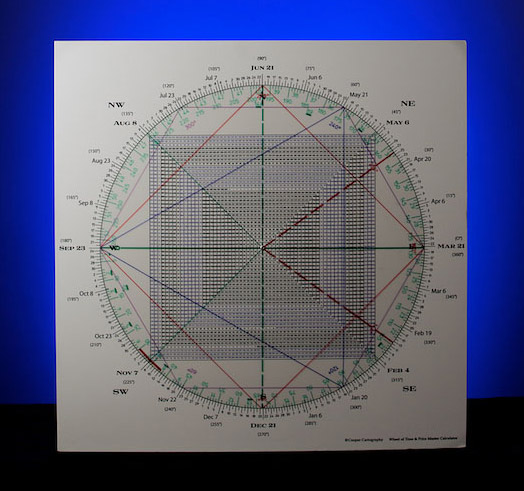

On my Square of 9 Calculator, 95 ‘points to’ July.

Square of 9 Wheel

Purchase your own Square of 9 Wheel. Shipping to US only. Contact Jeff for shipping outside the US.

In fact, the DJIA 386 record high in 1929 ‘points to’ July 16th, the record high in 2024.

It is well know that the pattern between the crashes in 1987 and 1929 are nearly identical.

As well the blow-offs preceding their pre-crash tops were 13 weeks.

From the April 2024 low to the mid-July 2024 top is also 13 weeks.

It is 58 years between those two crashes.

On the Sq of 9 Wheel the number 58 ‘points to’ August 1st.

This year August 1st was a pivotal point of recognition.

The SPX failed from an attempt to reclaim its 20 day moving average leaving a Holy Grail sell signal and a Large Range Outside Down Day (Lightning Rod/ LROD).

The market was talking. August 1st will prove to be a point of recognition for the current crash.

The next session produced a Breakaway Gap and a break of little triple bottoms where the SPX was clinging to its 50 day moving average.

All hell broke loose since August 1st.

August 1st defined the backtest of a Bottoms Line from the October 23rd low.

It was a defining point of recoginition

On August 2nd the SPX snapped a 3 point trendline (Rule of 4 Sell) from the April low.

Notice the 5 day rally attempt into August 1st.

This mirrors the 5 day or so rally in early October 1929 prior to the waterfall.

We are in the heart of the hurricane now.

In sum, yesterday saw a second close by the SPX below the aforesaid 5227 key level of 540 degrees down from the all-time high.

Interestingly, the next 540 degrees down, the next cube down is 4802.

That is important because it ties to the major January 2022 top of 4808.

Since prior resistance typically acts as new support I can’t help but think that the SPX will be magnetized to the 4800 region.

On the Square of 9 Wheel, 481 (4810) squares out with August 19th, a day when natural and market cycles converge.

Breakage below 4800 opens the door to the October 2022 low of 3490.

Amazingly 349 (3490) is opposite mid-July further validating the nature of the Top of Tops we witnessed a few short weeks ago.

Change happens slowly then all at once like a roller coaster when cycles converge.