“A terrible thing just happened, I realized I joined the wrong mob.” Lucky Luciano after visiting the New York Stock Exchange

“You might not feel it now

But when the pain cuts through

You’re going to know and how” Savoy Truffle, George Harrison X Dhani Harrison

I’ve been trading for nearly 40 years. I was the youngest hire at the famous Drexel Burnham Beverly Hills office.

I’ve seen a lot of crazy reactions to earnings over the years but nothing like what we’ve witnessed in the recent weeks.

NET exploded 25 points on Friday

MNDY surged 68 points on Monday

TWLO ran 24 points on Friday January 24

TEAM rocketed 40 points on Friday January 31

UPST erupted 21 points on Wednesday.

SPOT rocketed 72 points on Feb 4

It’s not all gravy train.

MDB tobogganed 58 points on December 10

SITM sank 46 points on Feb 6

GOOG caved 14 points on Feb 5

RDDT plummeted as much as 33 points after reporting on Wednesday.

It dropped to as low as 173 after hours where we posted on the Hit and Run Private Twitter Feed that 260 degrees down from the 230 peak is 173 and likely buyable the first time down for a trade.

It closed at 187 after-hours up 14 off the low.

Amazing.

TTD waterfalled 33 points after the close on Wednesday

MDB tobogganed 58 points on December 10

To mention a few. You get the point.

I can’t help but wonder if Wall Street is so smart how come the side of the barn can’t be hit?

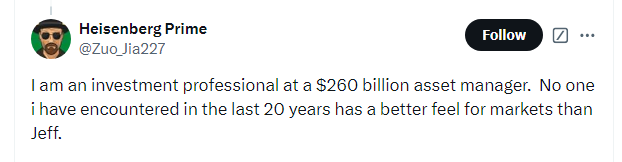

These bipolar strollers are part and parcel of the full frontal FOMO of what Goldman strategist Scott Rubner calls a “retail army”, an unexpectedly large group of retail investors who have been pushing their weight around in the market at the expense of institutional investors who have gotten used to owning the roost.

My Hit and Run members were involved in several of the above plays.

Here’s what you get with a subscription:

1)Private Twitter/X Feed with option and stock trade ideas and market commentary throughout the session.

2)A market macro and technical and timing overview in the Morning Report

3)actionable ideas every day

4) longer term position plays that can be held for multiple weeks ideal for the busy professionals who don’t have the time to follow the market all day.

Hit and Run has been providing market timing and long/short swing trades and day trades since 1996

See the performance in our archives cooperhitandruntrading.com and grab a free ebook on the Square of 9 Wheel

The troops are running amok while the generals, the mutual funds, hedge funds , banks and pension funds who have honed a methodical approach over the years have become deers in headlights.

It’s fitting that the generals on the buy side have been Trumped just as the generals called the Mag 7 have lost their leadership…except for one, META.

It started with the early August Flash Crash when the SPX bungeed back 350 points in 7 trading days.

Then recently we had the tail spin around DeepSeek which triggered a 1/5% drop for the SPX and a 3% drop for the NAZ. Data shows retail investors bought the blood on the Street.

And why not? The market’s been playing the Comeback Kid since 2009.

NOW retail is comfortable and confident after 15 years?

Then we had President Trump’s tariff announcements recently which sparked sharp losses, but once again indexes ended well off their lows.

Yesterday, once again, following a hotter than expected CPI, markets rebounded after a sharp gap down open.

A 10 min SPX the opening low, followed by an up ORB (Opening Range Breakout), a test of the low and a drive into Phil D Gap…the open gap.

A daily SPX for 2025 showcases the 4 sharp drops and immediate rebounds:

1) January 27 right off the January 24 all-time high. Even that nasty gap off a record high was not enough to detour the retail buying.

2) January 31. After filling the gap left by the January 27 plunge, the SPX reversed leading to

A massive down gap on Monday February 3 well below the 50 DMA. It could have been a Black & Blue Friday/Monday scenario ala October 16/19, 1987, but, drum roll, the Retail Mafia stepped in perpetuating a close well off the lows that reclaimed the 50 DMA.

3) Another large range reversal on Friday February 7th failed to mirror the previous Monday’s debacle. Instead the SPX rallied out of the gate this past Monday closing on its highs Monday and Tuesday.

4) Wednesday’s CPI elicited a sold 50 point gap down as offered above but the lions share of the losses were retraced.

In sum, Buy The Dip has become Buy The Dunk.

Retail investors are jumping at the chance to buy stocks as they fall.

Animal spirits are trumping risk to reward considerations…and their getting paid to do so.

They are learning some bad lessons that are going to spank them sooner than later.

In my trading career I’ve seen it happen over and over.

The little fools are dancing while the bigger fools are watching.

That was a saying from the Q 1 top in 2000…25 years ago.

We’re in 1/2 of the important 50 Year Jubilee Cycle.

Consider the 50 year Jubilee Cycle from the summer of 1932 (Great Depression price low) to the major low in the summer of 1982.

So the Jubilee Cycle marked the price low following the 1929 top and the price low that led to the Mother of All Bull Markets starting in 1982.

This one-half mark should prove extremely important,.

But although we have our eye on the big picture, we live and die by the short term sword.

The T Rex in the ointment in the short term for the bears is that yesterday’s rebound off the 50 DMA looks like it may have pulled the rubber band back for a shot at breakage above a 3 point trend line from the January 24 all-time high.

Trade above last Friday’s reversal triggers a Keyser Soze buy signal.

This is a Reversal of a Reversal ala the movie the Usual Suspects.

So a reversal that takes out the high of Friday’s outside down reversal and the Keyser is in town.

This would backstop the notion that the SPX will breakout above the aforesaid 3 point declining trend line.

“ It would seem too”; however, the market is so sloppy of late, that you never know. That said if the SPX “comes out” I don’t think we will see a nominal new high like played out on January 24 when the index peeked and peaked a tad above the December 6 prior record high.

We’ve been there and done that. I think if we do breakout that the likelihood is for more of a last ditch run…say to the 6240 region.

But should we clear last Friday’s highs and breakout, follow thru as always will be key.

We’ve seen too many false moves lately to take anything for granted.

As walked through in yesterday’s report, the SPX has gone nowhere following the run for the roses after the election.

But that hasn’t deterred the Momentum Mafia from focusing their guns on their usual suspects.

And the lackluster A/D Line just makes these target stocks all the more explosive: the fewer the names on the hit list, the more money they attract, like 10 pounds of poop in a 5 pound bag.

From my perspective, it seems that one of these day’s we’re going to see a big gap down and the Momentum Mafia will be licking their chops with glee…with one problem, the market doesn’t come back,

Let’s take a look at the big picture cycles.

On August 24, 1987, there was an exceptional alignment of planets. Eight planets were aligned in an unusual configuration called a grand trine.

The Sun, Moon and six out of nine planets formed part of the grand trine: they were aligned at the apexes of an equilateral triangle when viewed from the Earth.

The Sun, Moon, Mars and Venus were in exact alignment called a conjunction.

The market topped a day later on August 25 and began the path to the October 19th crash known as Black Monday.

Maybe something, maybe nothing, but on February 28th, 2025, all seven of the planets in the Solar System will appear in a neat row, known as a great planetary alignment.

A Convergence.

Between now and then on January 21, 2025, six of the seven other planets will appear in the sky at once in a large alignment.

Seven planet alignments are the rarest of all.

And of course, as W.D. Gann stated, “Seven is the number of panic.”

The 1987 crash started 7 weeks from the August 25th peak and culminated in the 8th week…mirroring the crash in 1929.

We are also having some strikingly similar astrology to 1929 right now. Although now a Harmonic Convergence.

Hoover was the president in 1929 and he was the last president to introduce tariffs.

As well approximately one million Mexican Americans were forcibly repatriated to Mexico.

In 1929, Jupiter was in Gemini as it is now.

In addition there was a Venus retrograde in Aires, and we’re about to have Venus retrograde in Aries.

To be clear I am not an astrologer, but have had the good fortune to count a few great financial astrologers amongst my friends.

What I have gleaned from them is that whether astrological cycles work because of electro- magnetic influences or not, the universe is synchronous.

What I am certain of is that psychology is synchronous with pattern and repetitive because human nature never changes.

This allows us to project time, price and pattern arriving at turning points.

W.D. Gann, an astrologer, and a master of the markets, said that while astrology is important, math is more important. He called it the Law Of Vibration.

Gann wrote “when time and price square-out, expect a change in trend.”

He also wrote that every important high and low is a square-out with a prior important high or low.

What Gann failed to add is that not every square-out is an important high or low.

In other words, it is the price action itself, the BEHAVIOR, that tells the tale of the tape.

I say it this way, speculation is observation, pure and experiential. Thinking isn’t necessary and often just gets us in trouble.