Over the years, Jeff has accurately predicted major market ebbs and flows. He’s been spot-on with everything from the crash of March 2020, to the meteoric rise in precious metals prices in 2024.

← Back to Powerful Market Insights“Just a matter of time now” –

–Artificial Energy, The Byrds

Sometime in the second quarter I expect the stock market to crash. Full stop.

It’s a mugs game to predict a crash and not only that but WHEN because crashes are rare birds.

But that’s not why you are here.

You expect me to call it like I see it.

That’s what I did on March 23, 2000 saying “the Bubble Top” is complete.

On August 30, 2000 saying “the most speculative part of the market, the NAZ, is as dangerous as the DJIA was at the end of August 1929.”

Hit and Run called the exact week of the bear market low in early October 2002.

The week of the top in October 2007.

The exact day of the bear market low on March 6, 2009.

The long-term gold top in early September 2011.

The January 2018 air-pocket.

The Dec 2018 crash.

The Jan/Feb pre-crash top in 2020.

The exact day of the crash low on March 23rd, 2020 where predicted a run to 4000 within a year.

The TLT low in late October at 82-83 prior to a run to 100.

A Spring Crash is my expectation. I think I have a handle on the time-frame and as things unfold I will define the precise timing.

I would not start buying puts now.

There is a chance the market could melt-up beyond 4900 before the deluge.

That is not my expectation at this point.

But of course I will update every day.

The point is not to get carried away by euphoria.

We can take advantage of short term long plays while remaining intellectually bearish until the river card flops and we see the whites of Mr. Market’s eyes.

To get a crash, you should have high valuations preceding the event.

Extreme valuations can persist for some time.

The back drop to this extreme valuation was the Fed taking Fed Funds to zero at the beginning of 2009 and kept it there until the end of 2021 when they gave up on inflation being transitory.

The Fed Funds rate was zero for half this period and I think averaged ½% throughout.

To state the obvious, interest rates are stimulative.

Rates were artificially low.

Translation: the economy and markets were artificially stimulated.

After 13 years of this people start to believe this is normal, that it’s the way it’s always going to be.

It’s not normal and it’s not the way it’s always going to be.

Now because certain segments of the market have recovered all the losses in 2022…and then some, market participants think stocks are back to “normal” ….that the market had its correction, the bear market is over and it’s a new bull born in October as evidenced by the momentum of the last 3 months where the SPX has closed below a prior weeks low just once—in the first week of 2024.

In fact that was the only week the SPX has traded below a prior weeks low since October 27, 2023 low.

You can’t blame market participants for buying Hook Line and Sinker into the idea of a new bull market because the market has shrugged off rates that have remained high and has shrugged off geopolitical tensions as well.

War Cycles are due to exert their downside influence.

Along with valuations, these are headwinds that momentum alone cannot overcome.

How expensive are U.S. stocks?

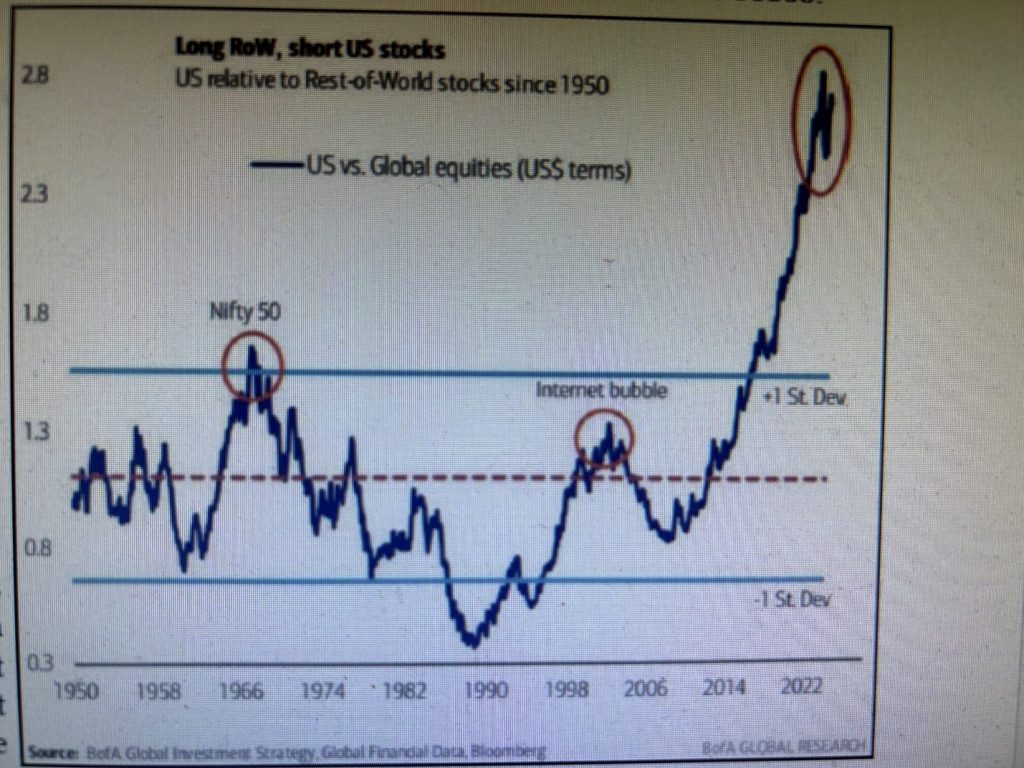

Stocks around the world are overpriced, but U.S. stocks are way overpriced. The discrepancy shown in the chart below is so great it’s difficult to fathom.

Any number of narratives can be invented to “justify” this; that’s what Wall Street does best.

The ‘This Time It’s Different” conga line.

But the fact is U.S. stock valuations will not stay stretched forever.

Cycles tell me this chicken is coming home to roost sometime in the next few months.

I will get more into cycles as my roadmap unfolds.

Suffice to say that if I am correct the SPX should top around the 4900 region.

Time-wise if my cycle work is correct mid-February represents an extreme …whether that’s a high or a test of a high made in coming days.

If we start to make lower lows and lower highs from that point, it gets very interesting for a

major play for us.

I will continue to map the potential for this setup week by week.

Suffice to say I have a Panic Cycle that should hit within the next 3 months.

Interestingly, the market has been keying off a 3 month (90 degree/day) cycle of late.

As we know this week is 180 degrees from last July’s important peak and 90 degrees from last October’s major low.

That puts April in the cross-hairs for the moment.

On April 8th we get a solar eclipse…not just any eclipse.

It is the second Great American Eclipse. The first one was August 21st, 2017.

The SPX went vertical that week running from a low of 2417 to 2872 at the end of January 2018.

A nearly 20% advance in 22 weeks.

The Rule Of Alternation suggests this time we may get a mirror image of the 2017 vertical move.

An equivalent-near 20% rally off the 4100 October 2023 love equates to 4900.

That’s not how I came up with 4900. It’s just more synergy.

The 4900 projection comes from a Time/Price square out this week with 489 SPY (4890-4900 cash).

Remember that 49 is an octave of W D Gann’s Panic Zone…7 being the number panic as Gann wrote.

In December the Q’s struck a nominal new high above their November 2021 peak.

The Q’s came out last Thursday.

As shown in yesterday’s report they left a signal reversal bar at a square-out:

January 22 points to 424.75,

That area is set to be tested again today.

Whether they Over Throw this idealized square-out or not the big picture warrants caution.

In sum, yesterday the SPX left a 180 buy setup and another N R 7 Day as yesterday’s Lizard sell setup failed to generate any downside follow thru.

Was Tuesday a Paws (Pause) Day after Monday’s little reversal bar or is this where we get the drive to 4900?

Tuesday was an indecisive choppy session until the last hour when the market rallied.

Be that as it may momentum was MIA.

NYSE Breadth was negative by 93 issues.

NAZ Breadth was negative by 84 issues.

NYMO fell versus Monday.

NAMO fell versus Monday.

A rally day in the SPX while NYMO is negative, such as Tuesday, typically produces a drop.

However, NFLX, was up 50 points after reporting after the bell carrying stocks higher in the after market.

The SPX is one good rally day from satisfying 4900.

At the same time, IWM, The Truth Teller, spiked open well above its 20 day moving average but closed sharply lower.. below its 20 day moving average.

IWM rallied sharply off its 50 day line last week and now is trying to convert its 20 day ma.

Tuesday’s reversal came after it turned up its 3 Day Chart on Monday.

It will be important to observe the action should it trace out 2 consecutive lower daily lows going forward as this will put it in the daily Plus One/Minus Two buy position.

It that plays out and The Truth Teller falters, it will be a canary in the bear mine.