“TIME is the most important factor in determining market movements and by studying the past records of the averages or individual stocks you will be able to prove for yourself that history does repeat and that by knowing the past you can tell the future.” W D Gann

While TIME is the most important factor influencing market trends, It is given short shrift on Wall Street that worships at the altar of price.

In my experience, there are no gurus, only cycles.

Patterns are the markets DNA, the double helix of Time and Price.

Whether we like it or not, as traders we are in the pattern recognition business.

At the end of the day it’s the interpretation of patterns upon which successful speculation depends.

The repetition of patterns is in the stock market is something that legendary trader W D Gann based his methodologies on.

What we’re looking for as traders is for the market to telegraph its intentions by its patterns and by something that is “off-pattern”, in other words when the market doesn’t do what is expected, it’s talking.

We are looking for something unusual in the market, a tell, a change in character, to inform us.

The works of W.D. Gann have inspired me more than anyone else. It was from his writings that I discovered cycles, patterns and psychology dominate the markets.

Wall Street tries to sell you on an array of funymentals (fundamentals) and earnings projections and economics and other news items that their “research” club holds the key to. They try to sell us that the news makes the markets. To the contrary, my experience has taught me that the news breaks with the cycles, not the other way around.

“There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.” William Delbert Gann.

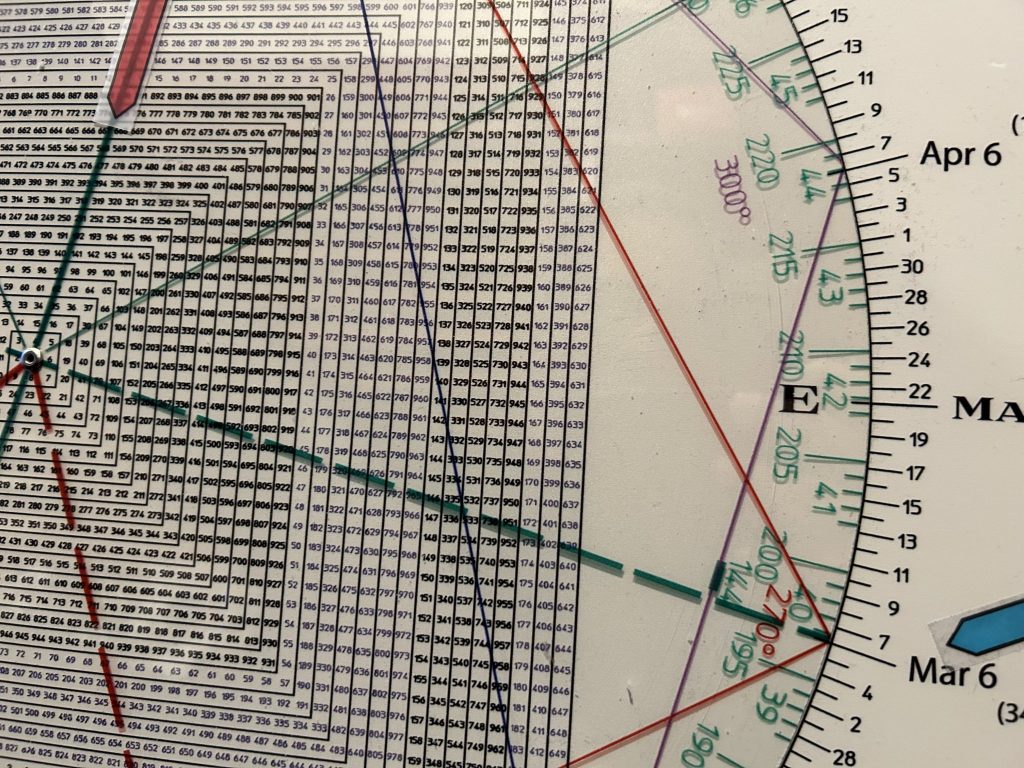

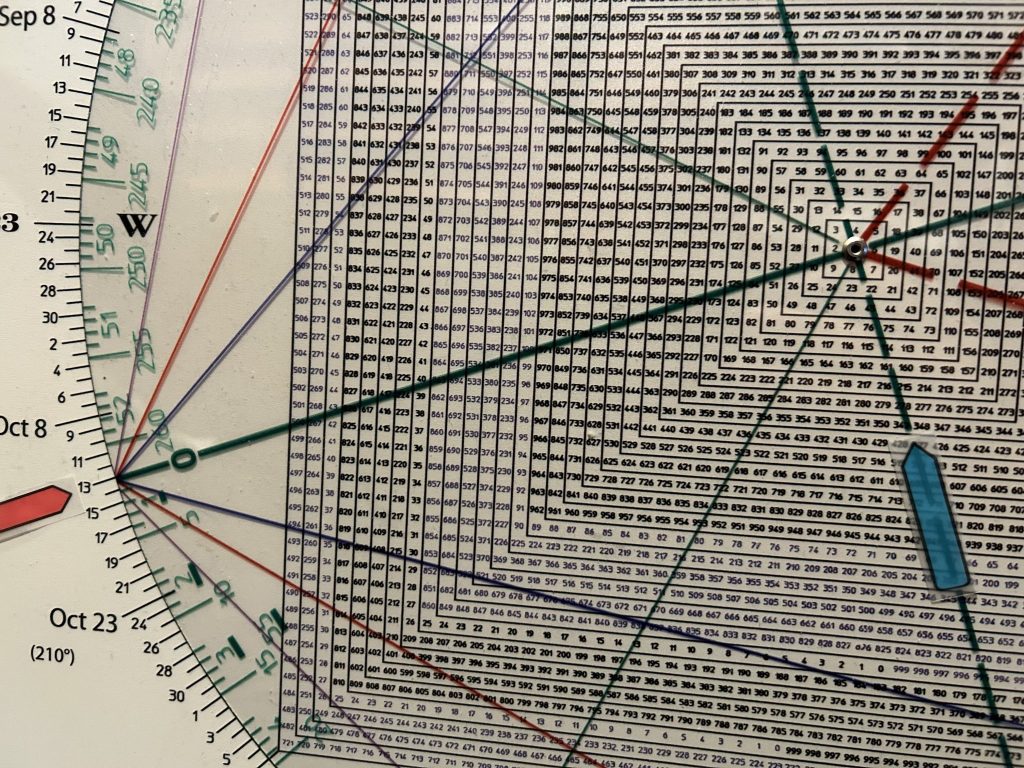

On March 6, 2009 the S&P 500 struck a bear market bottom at 666.79

Blue = March 6

Red = 666/667 for a Time/Price square-out

Infallible? No. The market can do anything at any time.

But good judgement is based on an edge and experience.

My edge is 30 years of experience working with the Square of 9 Time/Price Calculator.

That in conjunction with pattern analysis using my 3 Day Chart and 3 Week Chart Methodology and my proprietary strategies give Hit and Run a calculated edge.

We cannot rely on any guarantees in the markets.

All we have are inflection points and setups.

Setups are just setups and the unexpected can happen all the time.

This is why the key to this game is defense and cutting losses quickly.

Never confuse your position with your best interest.